Thank you !!I think you should just try to tell a short story about yourself. Let the reader know where you are from, a few of the personal interests and hobbies you have (especially the ones you would not necessarily put in a 'Why you' section), a bit about you general academic and professional journey and how that led you to law. Depending on wordcount limits you can decide what should stay in and what should not, but I think you should definitely have at least one or two sentences addressing this introduction part.

TCLA Vacation Scheme Applications Discussion Thread 2024-25

- Thread starter Jessica Booker

- Start date

-

- Tags

- vacation scheme

Is this the Paul Weiss online open day?Over 300 on the call, and noticed all their associates have a 1st class undergrad degree... Ah well, that's as close as I will get to the Paul, Weiss office... Saved me a few hours over the Xmas hols...

Lmao I slept through it -as I was working very late last night, but I get fed up with sitting through these “online open days” for 5 hours.. only to apply to the firm and get rejected.

What the hell, I’ll try my luck next year!

I mean they have their advantages. It’s easier than an in-person one. In-person open day feels real. I honestly prefer them where possible. Incredibly competitive though to get either. I think they’ve helped me previously. It’s just showing more commitment, IMO. Obviously it’s not the only way.Is this the Paul Weiss online open day?

Lmao I slept through it -as I was working very late last night, but I get fed up with sitting through these “online open days” for 5 hours.. only to apply to the firm and get rejected.

What the hell, I’ll try my luck next year!

Back to Paul, Weiss’s Vacation Scheme. They’re only hiring 10 trainees ultimately. 300 open day attendees is insane. Plus the in-person open days. Attending probably isn’t enough to progress. Depends how you package the experience. Best of luck with your apps.

lol me and my lazy ass, I think I’m burnt out from blitzing all these online events and applications since September. I looked at the clock when I woke up and it was 2pm… so I just thought what the hell, and resumed my shuteye!I mean they have their advantages. It’s easier than an in-person one. In-person open day feels real. I honestly prefer them where possible. Incredibly competitive though to get either. I think they’ve helped me previously. It’s just showing more commitment, IMO. Obviously it’s not the only way.

Back to Paul, Weiss’s Vacation Scheme. They’re only hiring 10 trainees ultimately. 300 open day attendees is insane. Plus the in-person open days. Attending probably isn’t enough to progress. Depends how you package the experience. Best of luck with your apps.

I do agree with you about their advantages and also much prefer in person open days than online. I will miss attending in person open days once I’ve secured a TC because I enjoy the process learning so much and meeting people at the firm and other attendees… in fact I’ve made a one or two very close friends through an in person open day I attended.

Defintley agree that it shows a commitment, I’ve seen that Allaboutlaw are hosting a webinar with Paul Weiss in Jan, so will look into that.

Numbers wise it’s overwhelming but it’s worth a shot. You never know, it may be you who ends up with a TC offer at Paul Weiss- you may just end up surprising yourself.

Wishing you a lovely Xmas and all the best with your applications and upcoming TC endeavours

@Amma Usman @Andrei Radu @Jessica Booker.

Could you give me some pointers on structuring my answer to the work experience section? The firm asks for my job title and then, “What skills have you acquired, and why are they relevant to a career in law?”

Should I briefly describe how I used specific skills in the role (e.g., communication in a customer service job: interacting with customers and giving clear instructions to colleagues) before linking them to a legal career? Or should I skip the context and focus directly on how the skill applies to being a commercial solicitor?

Could you give me some pointers on structuring my answer to the work experience section? The firm asks for my job title and then, “What skills have you acquired, and why are they relevant to a career in law?”

Should I briefly describe how I used specific skills in the role (e.g., communication in a customer service job: interacting with customers and giving clear instructions to colleagues) before linking them to a legal career? Or should I skip the context and focus directly on how the skill applies to being a commercial solicitor?

Oh no, how was it hard? I am about to do it.Did anyone else find the Dentons VI unnecessarily hard this year? Well sigh going to firm that rejection now

Hello everyone

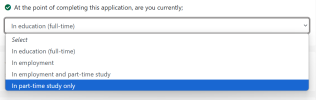

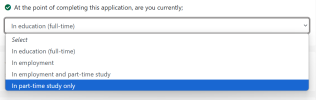

I had a doubt regarding my Cooley application - they have a question regarding 'what stage are you in at the time of application'. However I'm not working currently and am a recent graduate, so I'm unsure of what to put down for this question. If anyone could help out, I'd be immensely grateful

@Ram Sabaratnam @Amma Usman @Andrei Radu, any thoughts on this would be highly appreciated

I had a doubt regarding my Cooley application - they have a question regarding 'what stage are you in at the time of application'. However I'm not working currently and am a recent graduate, so I'm unsure of what to put down for this question. If anyone could help out, I'd be immensely grateful

@Ram Sabaratnam @Amma Usman @Andrei Radu, any thoughts on this would be highly appreciated

Last edited:

Idk if this is just my perspective but I've never found open days particularly helpful. Last year, I did open days at multiple firms (W&C, Shearman, TW, Jones Day, Latham) and didn't get any offers from them (but I did get a VS offer from a firm I had not done an open day with). I did the October open day at Paul, Weiss and I don't think it really gave me much better insight into the firm than I would have scanning the internet. I think it might just be a thing to show off on an application, but even then idk whether 'I attended an open day' is enough to secure a VS with them. I think if you have a genuine interest in PE, just apply and see whether they see potential in you.lol me and my lazy ass, I think I’m burnt out from blitzing all these online events and applications since September. I looked at the clock when I woke up and it was 2pm… so I just thought what the hell, and resumed my shuteye!

I do agree with you about their advantages and also much prefer in person open days than online. I will miss attending in person open days once I’ve secured a TC because I enjoy the process learning so much and meeting people at the firm and other attendees… in fact I’ve made a one or two very close friends through an in person open day I attended.

Defintley agree that it shows a commitment, I’ve seen that Allaboutlaw are hosting a webinar with Paul Weiss in Jan, so will look into that.

Numbers wise it’s overwhelming but it’s worth a shot. You never know, it may be you who ends up with a TC offer at Paul Weiss- you may just end up surprising yourself.

Wishing you a lovely Xmas and all the best with your applications and upcoming TC endeavours

I would interpret this as 'Why the firm', in which case I would do 3 paragraphs: 1. the work (most important thing-maybe practice area ur interested in bolstered by rankings on Chambers- their rankings are not great), 2. the culture (whether small trainee intake, early responsibility etc.), 3. pro bono work they have done and/ OR diversity and inclusion; however, given they have no direct question on the app about 'why commercial law', you could open with "I’m keen to become a commercial solicitor due to the unique blend of legal and business advice that characterises commercial law........(one sentence). I am interested in DWF primarily because of its London-based top-tier Banking & Finance practice.....250 words is not a lot, so use your judgment. Good luck!For this question: What are your motivations for wanting to pursue a career as a Solicitor at DWF? (250 words)

Do I need to split my answer equally between why commercial law and then why DWF? Or say why DWF only? Any help is appreciated!

I agree to a degree. They can be a colossal waste of time, especially if you work and study or don't live in London. That said, if you're in year 1 or 2 and don't work, they can be helpful in getting to know the firm and the people and little tidbits for the application that can make your application shine. I've been to one at Weil 2 years ago and one at HL this year and both gave me useful application nuggets. I would say you can get the exact same info through research, so it's not a must, but it can be a plus. Also, free food and drinks are always welcome.Idk if this is just my perspective but I've never found open days particularly helpful. Last year, I did open days at multiple firms (W&C, Shearman, TW, Jones Day, Latham) and didn't get any offers from them (but I did get a VS offer from a firm I had not done an open day with). I did the October open day at Paul, Weiss and I don't think it really gave me much better insight into the firm than I would have scanning the internet. I think it might just be a thing to show off on an application, but even then idk whether 'I attended an open day' is enough to secure a VS with them. I think if you have a genuine interest in PE, just apply and see whether they see potential in you.

Interestingly, a friend of mine went to an open day and had a chat with a partner (global head of PE at a US firm) who told him to email him if he applied. He did, and the partner emailed grad recruitment and said to look out for his application; he is now doing his TC there!

Last edited:

In employment. I suspect that if you select any of the others, it will try to solicit more information.Hello everyone

I had a doubt regarding my Cooley application - they have a question regarding 'what stage are you in at the time of application'. However I'm not working currently and am a recent graduate, so I'm unsure of what to put down for this question. If anyone could help out, I'd be immensely gratefulView attachment 6540

This is very restrictive, oh my. It doesn’t even catch self employment. I would put in employment lol. Applying feels like a full-time job.Hello everyone

I had a doubt regarding my Cooley application - they have a question regarding 'what stage are you in at the time of application'. However I'm not working currently and am a recent graduate, so I'm unsure of what to put down for this question. If anyone could help out, I'd be immensely gratefulView attachment 6540

Nope, they just sent me an email saying that I didn't pass the benchmark in the online testdid they send you an initial email saying you past the benchmark on the online test?

Any thoughts on how to tackle these questions from Withers and Penningtons Manches Cooper respectively?

1. If your favourite childhood toy suddenly came to life, what advice would you give it today? (60 words)

2. If you were the CEO of Penningtons Manches Cooper, where would you look to open a new office and why? (250 words)

Thanks!

1. If your favourite childhood toy suddenly came to life, what advice would you give it today? (60 words)

2. If you were the CEO of Penningtons Manches Cooper, where would you look to open a new office and why? (250 words)

Thanks!

Do you know if they review VIs on a rolling basis?Weil VI link came through - have until 5th Jan to complete

1. If your favourite childhood toy suddenly came to life, what advice would you give it today? (60 words)

Sometimes I wonder if these firms want people to just make stuff up lol. I never had any childhood toys past an age where I can remember. Furthermore some people's favourite toys could be something like a lego... anyways I guess they're looking for creativity and for you to perhaps introspectively assess your past experiences to summarise what you've learnt in the period between being a child and now. Maybe try and align with the firm's values if possible as well. It's also 60 words so conciseness is probably assessed.

Last edited:

My cue to not apply there cause I REFUSE to answer questions like this omgAny thoughts on how to tackle these questions from Withers and Penningtons Manches Cooper respectively?

1. If your favourite childhood toy suddenly came to life, what advice would you give it today? (60 words)

2. If you were the CEO of Penningtons Manches Cooper, where would you look to open a new office and why? (250 words)

Thanks!

Hoping for a christmas miracle next week 🙏

Similar threads

- Sticky

- Replies

- 4K

- Views

- 569K

- Locked

- Replies

- 19K

- Views

- 3M

- Sticky

- Replies

- 0

- Views

- 18K

- Sticky

- Replies

- 53

- Views

- 70K