The energy industry directly provides a significant source of revenue for many law firms, particularly for the “go-to” firms in the energy sector, such as DLA Piper, White & Case, and Vinson & Elkins. However, the growth of the global economy and of virtually all other sectors is interlinked with energy to some extent, meaning that all law firms will be impacted by the success or demise of the energy sector. The future of the energy industry is now uncertain, as a result of the Covid-19 pandemic and potentially the worst global recession since the Great Depression. This article will explore whether this pandemic will be the death knell for the oil and gas industry and the trigger of a boom in renewables, and will investigate the impact that the crisis will have on business, the global economy generally, and law firms specifically.

no-repeat;center top;;

auto

10px

center

Oliver GillilandTCLA Writer

writer-image

center

20

20

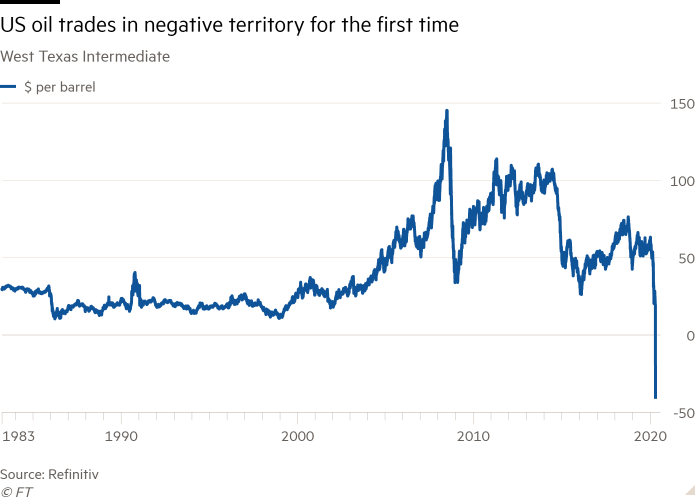

Early in April, financial markets were shocked by an unprecedented drop in the price of oil, which crashed into negative territory for the first time in history, reaching a price of -$40 per barrel — meaning that suppliers were effectively paying buyers to take oil off their hands.

The oil industry had already been struggling, coincident with the early stages of the pandemic, due to an ongoing price war between Saudi Arabia and Russia.

no-repeat;center top;;

auto

10px

20px 0 0

Peace negotiations in early April were initially promising. These negotiations led to the signing of a historic supply agreement between Opec+, the US, and some G20 nations to reduce global supply by 10%. The resulting restriction in supply would normally force a price increase, but this pricing factor was outweighed by a devastating 30% fall in global demand for oil and gas that resulted from the pandemic.

Prices initially reached negative territory due to technicalities regarding storage issues and how oil is traded through futures contracts for each month. The price eventually stabilised at around $20 per barrel, which is still incredibly low.

In order to fully appreciate the implications of rapidly declining oil prices, it is paramount to understand both the history of oil prices and to understand how oil prices affect the economy more generally.

no-repeat;center top;;

auto

10px

ECONOMIC IMPACT OF FALLING OIL PRICES

Oil is one the most crucial commercial commodities, as it provides more than one-third of the world’s energy and directly impacts the transportation and production costs of many businesses. Its uses also go beyond that of fuel, as it is utilised in plastics, clothes, ink, solar panels, and many more products.

In normal circumstances, a fall in oil prices would be great news for consumers and many businesses. When oil prices fall, consumers find themselves with an increase in discretionary income, as they are spending less on fuel and will generally increase spending on other goods. Meanwhile, businesses become more profitable as their production and transportation costs are reduced. The big commercial winners, in theory, should be those in the aviation industry, whose profitability is hugely dependent on oil prices. While businesses that are in the oil and gas industry will suffer as revenue and profits fall and there is less investment and exploration due to lower profitability.

However, because this specific fall in oil prices has been caused by expectations of a global recession and by the slowdown of all travel due to Covid-19, the drop in prices is unlikely to be accompanied by any overall offsetting positive economic effects: many consumers will be furloughed or lose their jobs, thus experiencing a decline in income, meaning that any decrease in transport costs will have a limited effect on their capacity to spend. In terms of the impact on business, despite falling production costs these will be offset by a reduction in demand (due to lower consumption) and by falling investment, as an economic recession creates uncertainty, and many investors will therefore be holding off on making investments until the global economy is more stable.

The unusual effect of this current fall in oil prices is best demonstrated by the dramatic impact it’s having on the aviation industry. Instead of becoming the expected big winners from an oil price fall, the industry has seen global demand come to a standstill due to travel bans, and their profits have plummeted; the S&P Supercomposite Airlines Industry Index is down 28% between February 2019-May 2020. However, it is important to appreciate the commercial reality for many firms impacted by falling oil prices is very different to the economic theory. The high levels of volatility surrounding oil prices mean that many companies, particularly airlines, hedge their fuel requirements in order to avoid sudden price moves – which means that these companies have already bought huge stocks of oil, and are paying hedged prices rather than today’s oil prices. Therefore, the cost-saving implications of record-low oil prices are less significant in practice than they are in theory.

On a basic macroeconomic level, oil-importing countries such as the UK, Germany, or Japan would normally greatly benefit from low oil prices. As the current account deficits (difference between export and import revenues) of these countries will fall, this will indicate that their economies are, on balance, globally competitive and an attractive investment. Although once again, such benefits will likely be offset by the global recession and reduced investment, as explained above. Meanwhile, oil-exporting countries such as Russia will greatly suffer, as they are heavily reliant on the tax revenue from oil exports in order to fuel government spending. In fact, it is estimated that Russia loses $2 billion in revenue for every $1 fall in oil price. Such a loss in oil-tax revenue can be anticipated to increase the Russian government budget deficit and to be either compensated for in higher taxes to its populace and/or to be reflected in reduced government spending, both of which actions would reduce the country’s economic growth.

no-repeat;center top;;

auto

10px

20px 0 0

A BRIEF HISTORY OF OIL PRICE MOVEMENTS

From 1999 to 2008, the price of oil soared to never-before-seen heights, peaking at $160 per barrel, due to a combination of rapidly increasing demand from emerging economies such as China, paired with production cuts by OPEC. The oil landscape radically changed after the financial crisis, which led to huge decreases in oil and gas demand and to falling prices, eventually reaching $53 per barrel. As the world’s financial system recovered, oil prices began to rise until, in 2014, the date of the previous most significant oil drop in modern history, oil prices plummeted once again — from $125 per barrel to as low as $30 by January 2016. This descent was caused by several factors: first, China’s rapid economic growth had begun to slow, and with it global demand also slowed; second, a price war between OPEC and the US erupted, one in which OPEC hoped that its refusal to cut production would result in a continuing collapse in prices that would make the extraction of oil in the US unprofitable and would put many of its competitors out of business. So, if the oil and gas industry could survive all this, what makes the Covid-19 situation any different?

no-repeat;center top;;

auto

10px

20px 0 0

AN INDUSTRY ALREADY PLAGUED WITH ISSUES – CLIMATE CHANGE & STRANDED ASSETS

Even prior to the Covid-19 pandemic, the oil industry was plagued with serious issues, namely climate change and the ensuing shift in global environmental policy. At the time of this writing, 194 countries have signed the Paris Agreement, including oil giants such as the US and Saudi Arabia. This is a commitment to keeping global temperature changes below 2°C, by means of carbon budgets. For purposes of compliance with this Agreement, it is estimated that 41% of global carbon is useable, and the rest would have to be left in the ground, thus becoming effectively worthless. The commitments created by this Agreement has serious cost implications for oil companies, estimated to cost up to $900 billion through the “stranded asset phenomenon”, in the “worst-case scenario” if temperature levels changes of 1.5°C are achieved (although it seems unlikely that even a 2°C change will be achieved by 2030). The stranded asset phenomenon essentially means that many investments that have already been made by oil companies — such as investments in explorations or infrastructure — will never see a return and thus are wiped off their balance sheets. The severity of the cost implications depends on whether the 2°C target will be met; the economic impact would be severely reduced, for instance, under the “best-case” scenario of 3°C per year, as in that scenario 96% of remaining carbon could be burnt.

Equally, there has been a shift in investor sentiment, as many investors are growing to see the value of investing in projects with “social value,” and see the oil industry as increasingly low-return and high-risk. This shift in sentiment is reflected by the rise of “green funds” such as Climate Action 100, which owns $35 trillion in assets and which puts pressure on companies in their portfolios to reduce emissions. Ultimately one needs to ask themselves, what is the point in investing in a company with falling profits, that reflects poorly on your portfolio in terms of Corporate Social Responsibility (CSR), and which by definition has only a finite amount of time left to even be able to produce an end-product?

The oil industry has already seen $400 billion wiped from its market value since 2017, so it may be premature to say it could not survive a $900 billion write-off, but its survivability looks more tenuous when coupled with the dramatic effects of the Covid-19 pandemic. The damaging impact caused by writing off a company’s assets will be explained more fully below.

no-repeat;center top;;

auto

10px

20px 0 0

IMPACT ON THE OIL INDUSTRY – COVID-19 & THE OIL PRICE WAR

As previously mentioned, the combination of Covid-19 and the aftermath of the oil price war has resulted in global oil demand falling by 30% and in the price of oil currently trading at $20 per barrel. The main impact of this is a tremendous imbalance between global supply and demand. On the supply side, global production has rapidly declined, with many oil wells completely shutting down and the US cutting back production by as much as 25% because there is not adequate demand to meet the supply, nor adequate storage to handle excess, as global oil storage capacity is only around 600 million barrels. (Global consumption was about 93 million barrels per day pre-Covid.)

Low oil prices have had a serious impact on profits, with the oil giants such as BP seeing a 67% fall in first-quarter profits. Investment is also expected to plummet: Wood Mackenzie offered an analysis in which it determined that an oil price of $35 per barrel would mean that 75% of projects do not even cover the cost of capital; and HIS Markit have also estimated that global capital expenditure (funds used to purchase new assets, or to upgrade or maintain current assets) in oil will fall by 20%. A reduction in revenue from falling oil prices and reduced investment, combined with the large write-offs previously mentioned from “stranded assets”, is particularly troublesome for oil companies, as they are generally very high-geared (borrow more than their income). To put this into perspective, the industry’s debt is a mind-boggling $1.9 trillion ($300 billion in bank loans) — in contrast, the value of US sub-prime mortgages before the 2008 financial crisis was $1.3 trillion. A large asset write-off coupled with falling revenue means that investors will be reluctant to put money into a company (as it is less likely to make a return), thus exacerbating the global reduction in capital expenditure; a company thus affected may be unable to meet its liabilities (debt) and will struggle to obtain further financing (using debt to pay off debt, otherwise known as “refinancing” or issuing bonds) and will likely need to pay a significantly increased interest rate, due to the inflated risk of default. The accumulation of these adverse conditions increases the risk of insolvency (when a company’s debt is greater than its assets). In 2019, there was already a 50% surge in US oil bankruptcy, and this trend of default is likely to be even more severe in 2020.

no-repeat;center top;;

auto

10px

20px 0 0

AN OPPORTUNITY FOR A GREEN TRANSITION?

The anticipated outlook for the renewable energy sector subsequent to the global pandemic has been a much brighter picture, compared to the hellscape of oil and gas. In fact, there have been many success stories: Orsted (a wind developer) reported a 27% first-quarter profit, and Iberdrola (a Spanish clean-energy group, which recently produced Europe’s largest solar plant) also reported a rise in first-quarter earnings of 5.3%. The International Energy Agency has also produced a report stating that the renewable sector will be the only energy source to see growth in 2020, albeit at a rate lower than that of previous years.

The success of the renewables industry is due to the fact that it is far more resilient than oil and gas. Unlike oil, which is finite in supply and controlled by a few big players, renewable energy is far less influenced by geopolitical relations, cartels, and supply agreements – meaning there has not been any price wars putting downward pressure on revenue. Equally, demand is protected in times of unprecedented demand-side shocks such as the Covid-19 pandemic, as many national grids are legally required to purchase renewable energy first. While there has not been a surge in green investment during the last month, renewables remain an AAA investment (whilst oil companies such as Apache Corp have seen their rating lowered from BBB to BB+), and many investments are still going ahead.

Not everything is sunshine and rainbows for the sector, as the Covid-19 pandemic will create some short-term difficulties. But unlike the situation for oil and gas, in the long run there is serious opportunity for a green transition and boom in growth. It should be noted that contrary to popular belief, falling oil prices will have a limited effect on the renewables sector. This is due to the current limitations of renewable energy, as they are rarely a direct substitute for oil. Oil is predominantly used for transport and heating, and also provides hydrocarbon gas liquid for the petrochemical industry (production of natural products such as natural gas and rubber). On the other hand, renewables are predominantly used for generating electricity, and oil is competitive here only at $15 per barrel, a price that would be unprofitable for producers. This sentiment around oil prices is shared by Barclay’s Head of Impact Investment Banking, who recently explained that “renewables are facing an economic, not oil price slowdown”.

The first short-term issue facing the sector is that of investment. Many energy companies will not have the funds available to diversify and invest in the current climate, as there is increasing pressure from shareholders to maintain dividends in the face of falling revenue and to maintain cash to survive the period of low demand. The lack of private investment from energy companies however, will be of limited impact, as this only accounts for 2% of renewables investment. Equally, there may be some minor indirect effects. As oil prices can influence the production of natural gas, which is a more effective substitute for generating electricity, meaning cheap natural gas could temporarily reduce further investment in renewables. More significantly, there may be diminishing global government funding, which accounts for 75% of investment in the renewable sector, either directly or indirectly, as funds are re-directed to preserving the economic well-being of their countries in the face of the Covid-19 pandemic.

Wood Mackenzie recently produced a report highlighting the impact of diminishing government support that suggested if there is a global recession extending beyond 2020, this could lead to 150GW of projects in the Asia-Pacific area (an area that is the global leader in wind and solar capacity projects) being cancelled or delayed over the next five years. The projected cancellations/delays are due to the reliance of renewables on government subsidies to remain competitive with coal-power stations, subsidies that may be slashed in order to re-focus the economy on a recovery. Other factors negatively affecting the renewable sector include the potential of increased financing costs if lenders are unwilling to provide favourable credit during a crisis, as well as lack of direct government investment.

The second short-term issue facing the sector is that there are significant supply-chain difficulties creating delays for many projects. This is primarily due to the industries’ high reliance on China, where manufacturing has not fully recovered. Wood Mackenzie has predicted that in a worst-case scenario, the US solar market will see 5GW of utility-scale markets pushed backed into 2021. (To help quantify the scale of this, it is useful to note that the entire UK solar capacity is 13GW.)

The long-term effect of this pandemic presents an unprecedented opportunity to accelerate investment into renewables, leading to a potential boom in green energy. In the private sector, energy companies will no longer be able to ignore the need to diversify their portfolios, as the combined effect of stranded assets and Covid-19 will effectively force them to adapt or fail. Once their revenue streams return to pre-crisis levels, it would make no sense to make further investments into high-risk oil and gas, where the rates of return at low oil prices are equal to those for energy products, and where asset life is extremely limited due to the finite nature of the assets. In Asia and the US, the consensus on government spending post-crisis appears to be ignoring renewables and a focus on an immediate recovery. However, there is a glimmer of hope in the EU, which has officially backed a “green transition” as part of it is one-trillion-Euro stimulus package. In practice, this means that EU governments will be investing in green energy as part of their plan for economic recovery, putting policies in place to boost demand for green alternatives (such as subsidies or requiring operators to use electric vehicles, etc.) and refusing to bail out businesses that cannot operate in a low-carbon economy, unless the businesses can commit to transitioning to net-zero. In the UK, the Labour party has also recently announced that it intends to put pressure on the Conservative government to facilitate a similar green transition as part of its Covid-recovery plan. Across the globe, Saudi Arabia’s Crown Prince Mohammed bin Salman has acknowledged the inevitability of a green transition and is keen to diversify his country’s heavily oil-dependent economy as soon as he can. This crisis may accelerate the country’s plan to diversify, which has already committed $30 billion in investment, as well as to cash out its oil reserves.

no-repeat;center top;;

auto

10px

20px 0 0

WILL THE OIL INDUSTRY SURVIVE?

Many commentators have suggested that, just as oil survived the financial crisis, oil will also make it through this pandemic. However, such a sweeping statement is a simplification of the scale of the issues and fails to acknowledge the key differences between the two crises. The fall in energy demand that the market is currently facing is seven times greater than that in 2008; pressure to facilitate a green transition is far greater; and, unlike in 2008, oil wells have actually shut down, putting the future oil supply into question. Ultimately, the survival of the oil industry depends on a mixture of geopolitical factors, consumer behaviour, the real impact of net-zero targets, and investment.

The most significant problem that oil currently faces, and the key to its survival, is that of demand. On the one hand, some analysts believe that the aftermath of the Covid-19 pandemic will fundamentally change consumer behaviour forever. For instance, if virtual working becomes commonplace, thus causing commutes to be drastically cut, and if business trips are no longer seen as essential, these changes will prevent the transport industry and subsequent oil demand from fully recovering. This demand problem is exacerbated by the global rush to net-zero, as countries actively try to cut down their carbon emissions and subsequent oil consumption. Under this view, it is believed that the peak demand for oil was already reached in 2019, three years ahead of schedule, according to analysts at Carbon Tracker, and that we are now entering an inevitable decline in demand. This view has recently been supported by the CEO of BP, Bernard Looney, who warned, “we may have already seen peak oil demand”. In contrast, BP’s earlier forecast back in 2019 predicted that oil demand would not drop off until 2030. Whilst analysts at Goldman Sachs predict that oil demand will not recover to pre-crisis levels until late 2022, primarily due to falling demand in the aviation industry (which accounts for 7.8% of global oil demand) and subsequent lack of demand to build new aircrafts.

On the other hand, some believe that there will be a surge in demand once lockdown measures are eased, as consumers will be in a flurry to travel again and will take advantage of cheap oil. Equally, it is debatable just how viable current green alternatives are, meaning that political momentum to reduce consumption of oil may be limited in practice, if renewables cannot fill the gap.

Equally, there will be significant supply issues resulting from a combination of oil wells shutting down, a huge decline in capital expenditure, and increasing difficulty for oil companies in obtaining financing – due both to their debt position and to their unattractive future investment outlook. This view is supported by analysts at Goldman Sachs, who predict supply will demonstrate an “L-shaped recovery” (slow). This means that even if there were a surge in demand, there would not likely be sufficient supply to capitalise on it.

Oil companies cannot stay profitable for long given such extremely low prices; US shale’s break-even price (where total costs = revenue) is $48 per barrel; Saudi Arabia’s is $83; and Russia’s is $42. If oil’s demand does not pick up, thereby forcing prices to remain low, at around $20-35 per barrel, the industry’s survivability will rest mainly on the geopolitical response to both the pandemic and the oil crash specifically.

Although the historic OPEC+ supply deal early in April went some way towards reducing the impact of collapsing demand on the industry, there is still much more that oil-producing nations need to do. The response of the US and Saudi Arabia will be pivotal here, as they are the two largest global oil producers. I have highlighted multiple options that governments may try to pursue in order to save the industry:

Pressure OPEC+ and other G20 nations to create further supply curbs: restricting supply even further will put upward pressure on prices. An oil powerhouse such as the US could use the threat of foreign oil tariffs to facilitate this, as it has done in its ongoing trade war with China. But this risks undermining US refineries that process foreign oil. Ultimately, this would be difficult to agree to in practice, and does not address the underlying demand problem.

Create artificial demand through issuing government bonds to buy up oil and store it until the price picks up. Mr Trump has in fact already proposed this solution, but his plans are unlikely to have any significant impact. The US can store only 75 million barrels, and globally there is only a 1.8-billion-barrel extra storage capacity, which means that any storage solution would account for only just over two weeks’ of global oil demand (93 million barrels per day).

Governments could also create artificial demand in a different way: by buying oil currently in the ground. Once prices recover, oil producers can then extract this pre-purchased oil and pay back the government with interest (the purchase thus acts effectively as a de facto loan) and can sell the oil on for a higher price. This would ensure that oil companies have adequate cash flows to meet their liabilities and would prevent any oversupply from forcing prices down even further.

A large-scale government bailout or provision of emergency financing. While this may save the industry in the short term by providing instant cash, this is generally an undesirable solution. Simply giving a company “free” or cheap money does not create any incentives to increase productivity (the oil industry being consistently criticised for lacking productivity and producers being unwilling to diversify their portfolios into renewables) and may reflect poorly on a government that provides such significant resources to an industry with such damaging externalities.

Simply let market forces take control. Arguably, by doing nothing, the weakest and least-efficient companies will be wiped out, and the more-efficient and larger companies will be forced to make productivity gains through investment, diversification, or buying up failing competitors in order to increase economies of scale (The larger the company generally means costs will fall.) This approach of course has the short-term downside of producing significant bankruptcies and significant unemployment, and it would almost certainly wipe out all small-scale oil producers who do not have the resources to adapt.

It is not entirely clear what action global governments will take, but Mr Trump is insistent that he will not allow US oil to fail, and other global governments are likely to follow suit. Mr Trump has already removed the “mercury emission rule” in order to alleviate costs within the industry, and he recently instructed the Energy and Treasury Departments to make funds available for oil companies through an emergency loan programme. A similar approach has been taken in the UK, where the Bank of England has agreed to buy oil companies’ debt as part of its £200 billion Covid-19 stimulus package via quantitative easing. While the EU has expressly excluded any fossil-fuel-related bailout, this represents only a small fraction of the global market. Ultimately, the oil industry is currently too big to fail for the key players, as their economies cannot cope with such huge-scale unemployment and are too reliant on oil as a tool of diplomacy (such as its use in the US-China trade war). However, while the oil industry may “survive” this pandemic, unlike the situation for oil following the financial crisis, oil will not return to business as usual this time around. Small oil producers will not have the cash reserves to withstand such a substantial shock in demand and will most likely be forced to file for bankruptcy and be acquired by the larger players. The oil giants that remain will likely become zombie businesses (un-profitable and reliant on government support for their survival), especially if cheap oil is the new normal. Irrespective of how quickly (if at all) demand recovers, as investment dries up, as the viability and cost-competitiveness of renewables improves, and as pressure increases to transition to a net-zero economy, it will no longer make sense to keep reviving an industry that cannot operate in a carbon-free world. In the long run, the Covid-19 pandemic will most likely accelerate the green transition by bringing forward peak fossil fuel demand, unleashing a surge in investment from governments such as the EU stimulus package, and putting increasing pressure on energy companies to diversify: those that fail to do so will not be able to survive in the long run.

For more on the problems of zombie companies, see my previous article: The Horde of the European Zombie Banks

no-repeat;center top;;

auto

10px

20px 0 0

IMPACT ON LAW FIRMS

The dramatic fall in oil prices and the shock to the energy industry will affect many law firms, even those that do not specialise in the sector.

Corporate: In general, as the decline in oil prices is part of a larger global recession there is likely to be a decrease in demand for M&A, as investment is reduced during times of uncertainty. However, many large oil companies may be looking to acquire failing smaller oil companies in order to reduce costs through economies of scale, or looking to acquire new businesses with renewable assets, as part of a diversification strategy.

Anti-Trust/Competition: If there is a significant consolidation of the oil market in the aftermath of the Covid-19 pandemic, there are likely to be significant competition law issues, and energy companies will be seeking advice in order to reduce these risks in their transactions, or to deal with claims from competition authorities. The main issue here is the potential for the abuse of monopoly power, as when a few large companies dominate the market they can influence the price as consumers have no viable alternative, or because due to their size and excessive cash reserves these companies are able to drive prices down (predatory pricing) in order to force out remaining competitors.

Litigation: Disputes are almost inevitable in any merger or acquisition, so as M&A activity increases in the energy industry there is likely to be a parallel increase in energy-related disputes. Equally, climate-change litigation, which is predominantly used to influence government policy, is likely to dramatically increase in the aftermath of the Covid-19 pandemic. Many climate groups will be wanting to put pressure onto governments to seize this unprecedented opportunity to facilitate a green transition.

Finance: In order to facilitate any M&A activity to either consolidate or diversify an energy company’s business, finding a favourable financial arrangement is key – so, many energy companies will be seeking advice on how to finance their responses to this crisis and to structure their deals. Equally, energy companies may be looking to privately invest into renewables or utilise government schemes/policy, so there will likely be a rise in project finance work. This is where lawyers create an arrangement that allows for the revenues of the project to pay back the debt rather than their balance sheet.

The immediate effect of the pandemic’s aftermath will likely be that many energy companies will be looking to law firms to facilitate re-financing arrangements (as mentioned above), as they are incredibly high-geared and will need new loan arrangements to stay afloat in times of reduced revenue.

Insolvency: It is likely that the fall in oil prices will mean many small oil producers will be unable to survive and will be forced to file for insolvency and that there will be a resulting increase in demand in insolvency-related legal work, such as negotiating corporate voluntary agreements or advising on whether to file for administration. Equally, companies on the brink of insolvency may be looking to restructure (sell off un-profitable parts of the business and re-negotiate debt to reduce costs) in order to avoid such a drastic situation, and such companies may seek legal advice in order to create a contingency plan.

Specialist Energy Firms: As the need to transition into renewables increases, many companies will be looking to energy industry leaders to utilise their deep industry knowledge for strategy and assistance with specialist matters. In particular, many companies will want law firms to draft Power Purchase Agreements (PPA), to facilitate their investment projects into renewable energy. These are contracts for generating, and selling to the grid, energy that your own assets have produced and offering the company the best price. A PPA will often be used when a company invests in a new energy project such as a solar farm and wants to utilise the energy generated from it.

no-repeat;center top;;

auto

10px

20px 0 0

default

default

Oliver is a member of TCLA\’s writing team. He is a recent law graduate from the University of Nottingham.

no-repeat;center top;;

auto